Have you ever come across the What is AOP in Finance and wondered what it actually means? Look no further!

This article will provide you with a clear understanding of AOP in finance, explaining its significance and how it is used in the financial world.

By the end, you’ll have a solid grasp on this concept and be able to navigate the world of finance with confidence. So, let’s dive right in and explore what AOP in finance is all about!

What is AOP in Finance

Definition of AOP – What is AOP in Finance

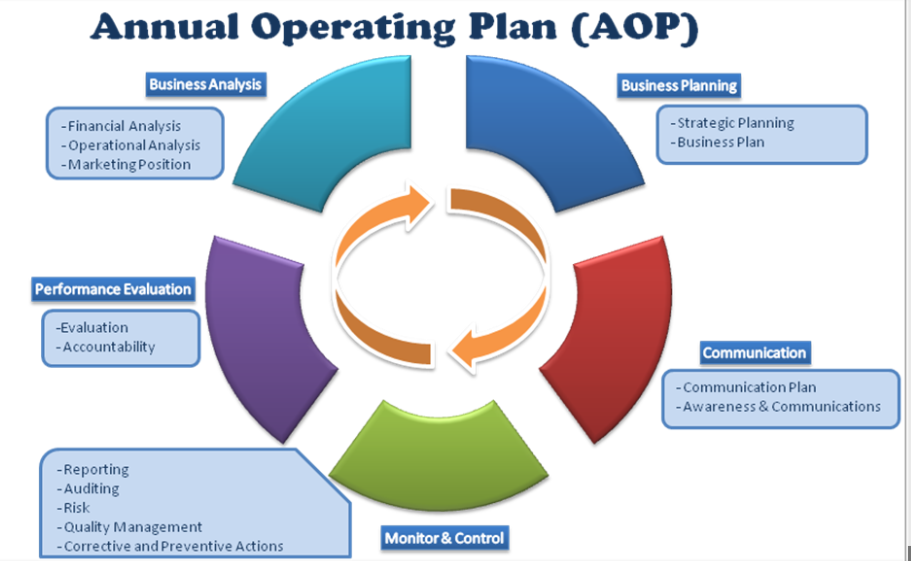

What is AOP in Finance, or Annual Operating Plan, is a key financial process used by organizations to plan and manage their financial activities for the upcoming year.

It is a detailed roadmap that outlines an organization’s financial objectives, targets, and strategies for the coming year.

The AOP serves as a blueprint for financial decision making, resource allocation, and performance evaluation.

Importance of AOP in Finance

The What is AOP in Finance plays a crucial role in the financial management of an organization. It provides a structured framework for setting financial goals, creating budgets, and allocating resources effectively.

By aligning financial objectives with business strategies, the AOP facilitates better decision making and ensures that financial resources are optimized.

Additionally, it allows organizations to assess their financial performance and take corrective actions if needed.

Process of AOP

The process of developing an AOP typically involves several stages. It starts with gathering and analyzing financial data from various departments and segments of the organization.

This data is then used to create a baseline financial plan, which outlines the expected revenue, expenses, and profitability for the upcoming year.

The plan is reviewed and refined through collaboration between finance teams, department heads, and senior management. The final AOP is then presented and approved by the organization’s leadership.

Key Components of AOP

The AOP comprises several key components that provide a comprehensive overview of an organization’s financial plans for the upcoming year. These components include:

- Revenue Projections: The AOP includes detailed revenue projections, taking into account factors such as market conditions, sales forecast, pricing strategy, and customer acquisition targets.

- Expense Budgets: It outlines the anticipated expenses for the year, including operational costs, employee salaries, marketing expenses, research and development investments, and other overhead expenses.

- Profit Targets: The AOP sets specific profit targets that the organization aims to achieve during the year. These targets often take into consideration factors such as market growth, competition, and industry benchmarks.

- Capital Expenditure Plans: The AOP includes a detailed plan for capital expenditures, such as investments in infrastructure, equipment, technology, or any other long-term assets required to support the organization’s growth and operations.

Benefits of AOP in Finance

The AOP provides several benefits to organizations in the field of finance. These benefits include:

- Improved Financial Planning: By outlining clear financial objectives and strategies, the AOP enables organizations to plan their financial activities in a structured manner, leading to better resource allocation and financial decision making.

- Performance Evaluation: The AOP serves as a benchmark for evaluating an organization’s financial performance.

By comparing actual results with the AOP’s targets, organizations can identify areas of improvement, make necessary adjustments, and monitor progress towards their goals.

- Alignment of Objectives: The AOP ensures that financial objectives are aligned with the organization’s overall strategic goals.

This alignment allows various departments and teams to work towards common financial targets, fostering collaboration and synergy across the organization.

- Enhanced Accountability: By setting clear financial targets and responsibilities, the AOP enhances accountability within the organization.

It provides a framework for measuring and tracking performance, thereby encouraging employees and teams to take ownership of their financial responsibilities.

Challenges in Implementing AOP

While the AOP offers numerous benefits, its implementation can pose certain challenges for organizations. Some of the common challenges include:

- Data Availability and Accuracy: Developing an AOP requires access to accurate and reliable financial data.

Organizations may face challenges in collecting and analyzing the required data from various sources, especially if their financial systems are not integrated or if data quality is poor.

- Limited Flexibility: The AOP is an annual plan designed to guide the organization’s financial activities for the entire year. However, in a dynamic business environment, unexpected changes may occur that require adjustments to the plan.

Organizations must strike a balance between sticking to the plan and being flexible enough to adapt to changing circumstances.

- Organizational Alignment: Developing and executing an AOP requires strong collaboration and alignment across departments and teams.

Organizations may face challenges in fostering this alignment, especially if there is a lack of communication or conflicting priorities among stakeholders.

- Economic Uncertainty: External factors such as economic downturns, market fluctuations, or regulatory changes can significantly impact an organization’s financial plans.

Adapting the AOP to address such uncertainties can be a challenge, requiring organizations to maintain flexibility and contingency plans.

Tools and Technologies for AOP

Several tools and technologies can aid organizations in developing and managing their AOP effectively. These include:

- Financial Planning and Analysis (FP&A) Software: FP&A software provides functionalities to create, analyze, and manage financial plans, including the AOP.

These tools automate calculations, data consolidation, financial modeling, and reporting, streamlining the AOP process and improving accuracy.

- Business Intelligence (BI) Tools: BI tools enable organizations to gather, analyze, and visualize financial and operational data.

By leveraging these tools, organizations can gain deeper insights into their financial performance, identify trends, and make data-driven decisions during the AOP process.

- Spreadsheet Software: Traditional spreadsheet software, such as Microsoft Excel, is often used to build and manage the AOP. Spreadsheets allow organizations to create detailed financial models, perform calculations, and generate reports.

However, they require manual data entry, can be prone to errors, and lack advanced collaboration capabilities.

- Enterprise Resource Planning (ERP) Systems: ERP systems integrate various business functions, including finance, into a single system.

These systems provide real-time data, enabling organizations to make informed decisions during the AOP process. ERP systems can automate data collection, consolidation, and reporting, improving the efficiency and accuracy of the AOP.

AOP vs Budgeting

While AOP and budgeting are closely related, there are some key differences between the two.

Budgeting typically focuses on short-term financial planning, often covering a fiscal year or shorter periods.

It involves creating detailed plans for revenue and expenses, with a primary focus on cost control and adherence to financial targets.

On the other hand, the AOP takes a more strategic approach, aligning financial objectives with overall business goals.

It provides a broader view of the organization’s financial plans, incorporating revenue projections, profit targets, and capital expenditure plans.

The AOP serves as a foundation for budgeting and guides resource allocation and decision making throughout the year.

AOP vs Forecasting

Forecasting is another financial process that is closely related to the AOP. While both involve predicting future financial outcomes, there are differences in their objectives and timeframes.

AOP focuses on long-term planning and goal setting, whereas forecasting typically looks at shorter time horizons, often up to a few months.

Forecasting aims to estimate future financial performance based on historical data and considers current market conditions. It helps organizations anticipate short-term revenue, expenses, and cash flow.

In contrast, the AOP serves as a strategic roadmap for the entire year and provides a comprehensive view of an organization’s financial plans, including revenue, expenses, and profitability.

Examples of AOP in Finance

Here are a few examples of how organizations use What is AOP in Finance:

- A manufacturing company develops an AOP that includes revenue projections from specific product lines, expense budgets for raw materials and labor costs, and profit targets for each department.

This helps the company align its financial goals with production capabilities and market demand.

- A retail chain creates an AOP that outlines revenue projections based on sales targets for different store locations, expense budgets for marketing campaigns and operational costs, and profit targets for each store.

The AOP allows the chain to allocate resources effectively and monitor the financial performance of each store.

- A technology startup develops an AOP that includes revenue projections from new product launches, expense budgets for research and development, marketing, and employee salaries, and profit targets based on market growth.

What is AOP in Finance helps the startup plan its financial activities, attract investors, and track progress towards its ambitious growth goals.

In conclusion

What is AOP in Finance plays a vital role in the financial management of organizations. It provides a framework for strategic planning, resource allocation, and performance evaluation.

Despite the challenges in its implementation, leveraging the right tools and technologies can enhance the effectiveness of the AOP process.

By aligning financial objectives with overall business goals, organizations can optimize their financial resources, make informed decisions, and drive long-term success.